Nashville Guest House

The Nashville Guest House is a new guest house that will be primarily for extended visits from friends and family. Secondary uses include short-term rentals such as Air BnB and art gallery events.

Concept Board

The home owners are interested in an aesthetic that merges contemporary design and natural materials.

Project Details

Project Goals

- Guest House for extended stay for friends and family

- Gallery Events

- Short-Term Rentals

- Potential Home Office

- Potential Long-Term Rental

Program

- Bedrooms, 2

- Full Bath

- Half Bath

- Kitchen

- Dining Room

- Living Room

- Office

- Storage Shed / Closet

- Yard / Landscaping

Budget

$100,000

Schedule

Project Start - January 2018

Go/No Go - December 2018

Construction Completion - December 2019

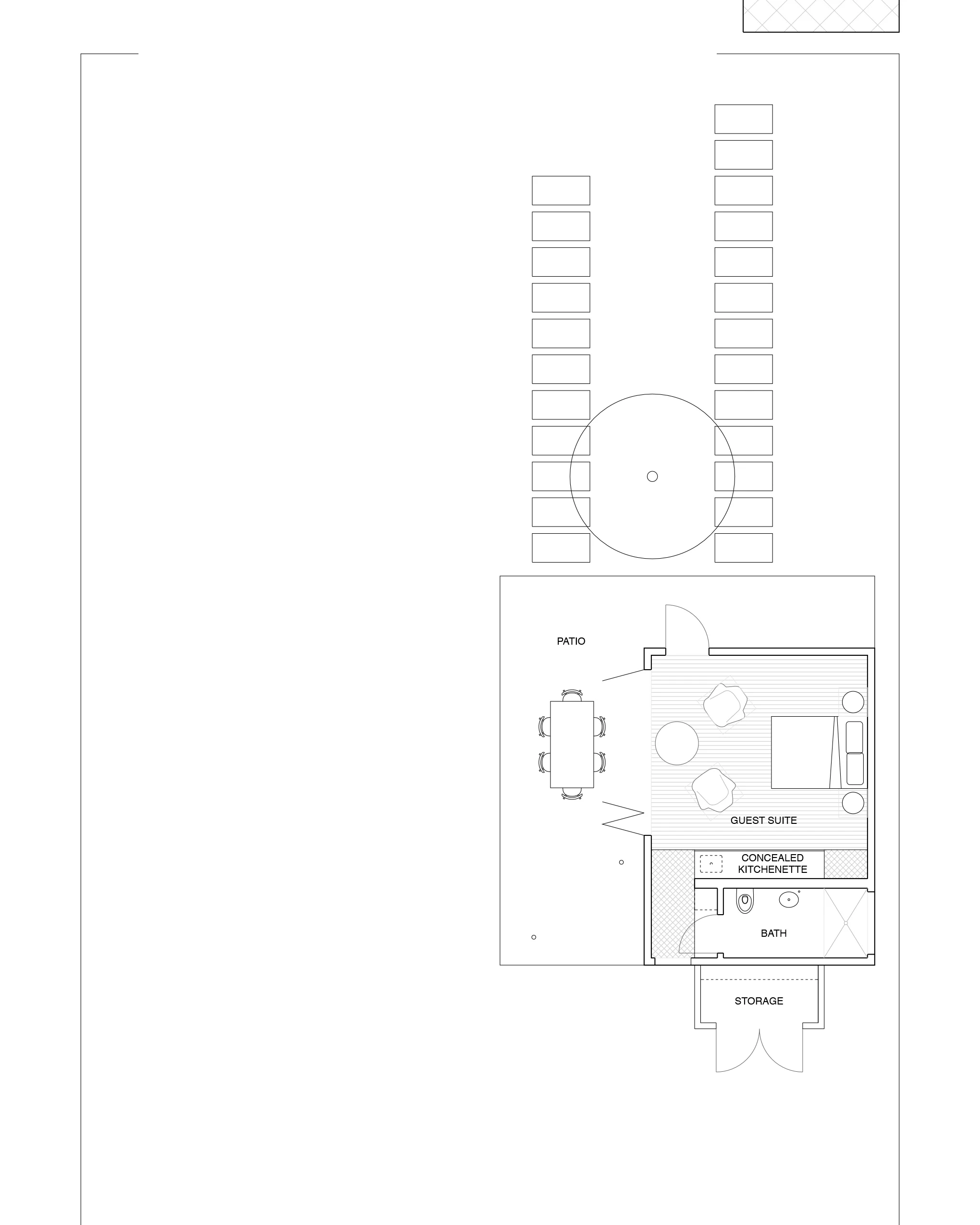

Floor Plans

Zoning, Land Use

Basic Information

Owner: Buist Hardison

Project Title: Nashville Guest House

Street: 1018 Delmas Ave.

City / State / Zip: Nashville, TN 37216

Neighborhood: East Hill, East Nashville

Parcel ID: 007209024500

Legal Description: PART OF LOT 40 EAST HILL ADD

Parcel Established: 10/29/1969

Lot Acreage: 0.22 ac / Lot SF: 9,424 sf

Frontage Dimension: 50

Side Dimension: 191

Zoning Classification: R6

Zone Description: Medium density residential, requiring a minimum 6,000 square foot lot and intended for single and two-family dwellings at a density of 6.17 dwelling units per acre.

NASHVILLE DISTRICT LAND USE TABLE

View Table at 17.08.030

Summary

The Guest House will be permitted as the second unit on a Two-Family dwelling lot. Once this permit is granted, the Guest House will be available to host friends and family or as a rental property. Should the home-owner desire to change use to a "Home occupation" or "Short Term Rental Property" at a later date, these uses are currently permitted by code. Four parking spaces, including 2 on-street spaces, will be provided.

Key for R6 Analysis

P — Permitted by right

PC — Permitted subject to specific conditions (Chapter 17.16, Article II)

SE — Permitted by special exception (Chapter 17.16, Article III)

A — Permitted as accessory to a principal uses (Chapter 17.16, Article IV)

O — Permitted within an overlay district

R6 Analysis

Single Family — P

Single Family dwellings are permitted by right.

Two-Family — PC

Two-Family dwellings are permitted subject to conditions. Because the property satisfies these conditions, we are permitted by code to convert the property from a Single Family to a Two-Family dwelling. Conditions: "(1) The lot is legally created and is of record in the office of the county register prior to August 1, 1984; (2) The lot is created by the subdivision of a parcel of land in existence prior to August 1, 1984 into no more than three lots; or (3) The lot is part of a subdivision having preliminary approval by the metropolitan planning commission on or before August 15, 1984, and having commenced any substantial site development or infrastructure improvements, such as utilities and streets, and a portion of such subdivision is recorded in the office of the county register prior to April 1, 1985".

Accessory Apartment — A

The Guest House as planned is a detached unit and therefore is not classified as an Accessory Apartment, reference Definitions section. Note that should the design change so that the Guest House does qualify to be considered an Accessory Apartment, use of this apartment will be limited by the code, section 17.16.250: (A6) The second unit must be occupied by a family member defined as grandmother, grandfather, mother, father, sister, brother, son, daughter, mother-in-law, father-in-law, sister-in-law, brother-in-law, son-in-law, daughter-in-law, aunt or uncle; (A8) An instrument shall be recorded with the register's office covenanting that the apartment is being established as an accessory use and may only be used under the conditions listed above.

Accessory Dwelling, Detached — PC

Though a Detached Accessory Dwelling is conditionally permitted, the Guest House is not considered a Detached Accessory Dwelling as is does not meet any of the four criteria listed in the definition for "Accessory Dwelling, Detached". Reference Definitions section. This assessment was made by reviewing the property using Nashville Metro's Parcel Viewer website. Reference Links section.

Home Occupation — A

A home office is permitted provided that is it is (1) accessory to the principal use, (2) carried on by one or more resident members of the dwelling unit, and (3) does not occupy more than 25% of the total floor area of the principal use and is not larger than 500 sf. Because the Guest House as designed satisfies all of these conditions, the home-owner would be allowed by code to use it as a home office. Note that (1) code prohibits clients or patrons to be served on the property, (2) no more than one part-time or full-time employee not living within the dwelling may work at the home occupation location, (3) signage is outside the scope of this project; should the home-owner at a future date desire to add signage for a home occupation, the municipal code should be consulted, and (4) the addition of a home occupation to the property will trigger additional parking spaces, reference Parking section.

Short term rental property (STRP), Owner occupied — A

Short term rental properties are allowed by code on the conditions that (1) the STRP is an accessory to the principal use, (2) that property—either unit—is owner occupied, and (3) that the STRP operator obtains an STRP permit. Because the home-owner will continue to occupy the property, the home-owner is allowed to use the Guest House as an STRP pending successful permit application. Note that code requirements effectively set the number of rentable beds, based on the number of sleeping rooms. The maximum number of occupants allowed in the STRP at any given time is set by # of Sleeping Rooms x 2 + 4. See 17.16.250 E.4.f. The maximum number of sleeping rooms allowed is four, reference Definitions section.

parking

View Parking Table and Parking Reductions Table at 17.20

Summary

Two-Family — 4 spaces (2x2 discounted 10% = 3.6 = 4 spaces)

Single Family + Home Occupation — 4 spaces (2+2 discounted 10% = 3.6 = 4 spaces)

Single Family + Accessory Apartment — 3 spaces (2+1 discounted 10% = 2.7 = 3 spaces)

Single Family + 1 br STRP — 3 spaces (2+1 discounted 10% = 2.7 = 3 spaces)

Single Family + 2 br STRP — 4 spaces (2+2 discounted 10% = 3.6 = 4 spaces)

Single Family + 3 br STRP — 5 spaces (2+1 discounted 10% = 4.5 = 5 spaces)

For all combinations, 2 spaces can be on-street parking.

Analysis

Single Family — 2 spaces

Two-Family — 2 spaces / unit

Accessory Apartment — 1 space

Home Occupation — 2 spaces (note: code sets equal to # required for principal use)

STRP — 1 space per sleeping room (note: the number of parking spaces for an STRP is not explicitly specified in the code. The code states "Nonclassified Uses. For uses not specifically classified in Table 17.20.030, the zoning administrator shall apply the parking requirements for a similar listed use." The most similar specified use seems to be "Historic bed and breakfast homestay" which specifies 1 space per guestroom, plus 2 spaces per dwelling unit. Our assessment is that the requirement of additional parking spaces due to the addition of an STRP to the site will be 1 space per sleeping room.

Discounts — 10% + 2 spaces can be on-street parking (note: because the property is within 660 ft from a transit route, the parking requirement is discounted by 10%. On-street parking is allowed against overall required parking for up to 2 spaces in Two-Family dwellings provided that spaces are directly adjacent the property).

Fractions — Municipal code provides clarification for fractions: "Fractions. Any fraction less than one-half shall be disregarded and any fraction of one-half or more shall be rounded upward to the next highest full number."

Definitions

View Definitions at 17.04.060

"Accessory or ancillary structure" means a structure detached from a principal building located on the same lot that is customarily incidental and subordinate to the principal building.

“Accessory apartment” means a secondary dwelling unit, attached to a single-family residence, the principal dwelling unit on a lot. The accessory apartment dwelling shall be subordinate in size, height, and purpose to the principal dwelling.

“Accessory dwelling, detached,” also referred to as detached accessory dwelling, means a detached dwelling unit separate from the principal single-family structure on a lot located within a historic overlay district, within any urban design overlay with development standards for detached accessory dwellings, on any lot with an improved alley abutting the rear or side property line or on any lot over fifteen thousand square feet. The dwelling shall be clearly subordinate in size, height, and purpose to the principal structure, it shall be located on the same lot as the principal structure, but may be served by separate utility meter(s) and is detached from the principal structure. A detached accessory dwelling can be an independent structure or it can be a dwelling unit above a garage, or it can be attached to a workshop or other accessory structure on the same lot as the principal structure.

"Home occupation" means an occupation, service, profession or enterprise carried on by a resident member of a family within a dwelling unit.

“Two-family”: 1. Two attached dwelling units that share the floor of a unit with the ceiling of another unit or a common wall from grade to eave at the front façade which continues for eighty percent of the common side or twenty feet, whichever is greater; or 2. Two detached dwelling units on a single lot which are separated by at least six feet. 3. In historic zoning overlays, the manner or existence of attachment shall be determined by the Metro Historic Zoning Commission.

"Short term rental property (STRP)—Owner-occupied" means an owner-occupied residential dwelling unit containing not more than four sleeping rooms that is used and/or advertised through an online marketplace for rent for transient occupancy by guests.

"Subdivision" means any subdivision of land as provided in Section 13-3-401 et seq. and Section 13-4-301 et seq., Tennessee Code Annotated.

Links

Nashville Metro Parcel Viewer

Nashville Metro Zoning Code

Nashville Urban Design Overlay Maps

Galatin Pike Urban Design Overlay Document

Nashville Zoning Table

Zoning, Building Envelope

Building Envelope, r6

Summary

The building restrictions given by the Zoning Code for the Guest House project are minimal. A 5'-0" side setback and rear 20'-0 setback must be maintained. Because the Guest House is being permitted as a second unit, maximum height is given as a Two-Family dwelling, 3 stories. Should permitting change wherein the Guest House becomes an accessory unit, the maximum height will be 1 story or 16'-0", whichever is less. There are no specific area coverage or area requirements given for the individual units of a Two-Family dwelling. However, it may be a good idea to keep guidelines for the maximum coverage for an Accessory Building in mind, 50% of the principal use coverage area or 700sf, whichever is larger. Note, however, that maximum lot coverage for both structures is 50%. Reference image below.

Download Rhino File

Analysis

Minimum Lot Size — 6,000 sf

Maximum Building Coverage — 0.50

Maximum Floor Area Accessory Building — 50% coverage main building or 700 sf, whichever is greater, not to exceed 2,500 sf

Minimum Rear Setback — 20 ft

Minimum Side Setback — 5 ft

Front Setback — Match average of nearest (4) Single- or Two-Family residences; not to exceed 60'-0"; front setback is measured from centerline of right-of-way

Maximum Height — 3 stories

Maximum Height Accessory — 1 story or 16 ft, whichever is less

Links

Project Scope Diagram

Cost Estimate

| Guest House Size | 800 SF | 1000 SF | 1200 SF |

|---|---|---|---|

| - | - | - | |

| Cost per SF Construction @ $86.65/SF | $68,519 | $85,648 | $102,778 |

| Contractor Profit, Overhead & Expenses @ 15%, 5% | $13,704 | $17,130 | $20,556 |

| Contingency @ 15% | $12,333 | $15,417 | $18,500 |

| - | - | - | |

| Total | $94,556 | $118,195 | $141,834 |